INSTALLMENT PLAN

INSTALLMENT PLAN

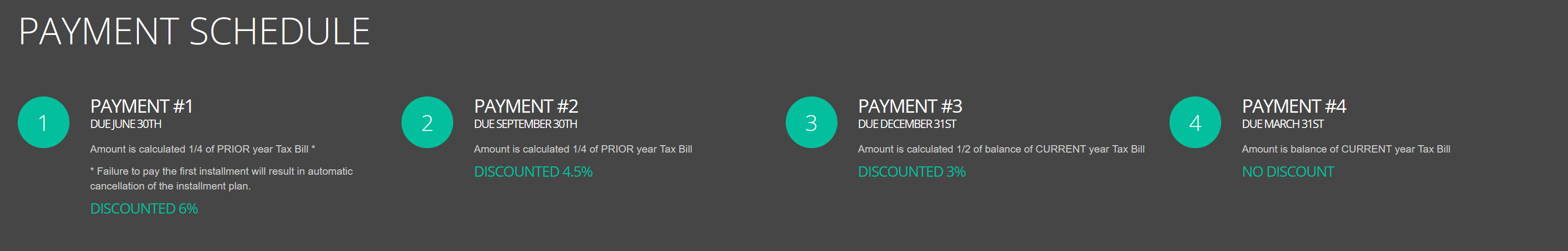

Taxpayers may choose to pay their property taxes quarterly by participating in an installment payment plan. To be eligible for the plan, the estimated taxes must exceed $100.00. Those who qualify must submit an Installment Plan Application form to the Tax Collector’s Office on or before April 30th. Application forms are available online or at any Tax Collector’s office location between November 1st and April 30th. An application to participate in the installment payment program is for the NEXT tax year, not for the current year’s taxes. Once enrolled in the plan a new application is not required as long as the first installment payment is made each June.

Property owners that escrow tax payments with a mortgage company should NOT pay by installments. Mortgage companies are obligated to pay taxes in November to obtain the maximum discount. If you are planning to refinance or sell the property it is not suggested that you participate in the installment payment program.

The combined discounts for the installment plan calculate to a rate of approximately 3.3%. Once you are enrolled in the installment plan and make the first payment you are only entitled to the discounts set forth in the plan. Tax payers should decide which payment method works best for their individual situation, an annual tax bill or quarterly installments.